Mixing personal and business finances is one of the most common yet overlooked accounting mistakes small business owners make. It often starts with a single “harmless” purchase—using the wrong card, paying a bill from the wrong account, or transferring funds without documentation. But over time, these small missteps build into significant accounting problems that can lead to tax issues, inaccurate financial reporting, and serious cash flow confusion.

At Accountix Solutions, the team sees the impact of mixed finances almost every week. The same patterns appear again and again: personal expenses coded as business deductions, business accounts used to cover personal bills, shared credit cards used inconsistently, and missing documentation that makes it impossible to distinguish one type of transaction from another. These aren’t rare exceptions—they’re some of the most frequent issues discovered during bookkeeping cleanups and financial reviews.

Through years of correcting mixed transactions and rebuilding clean, reliable books, Accountix Solutions has developed a clear understanding of why this problem keeps happening—and how to fix it fast. This guide brings together those insights, explaining the risks of mixing funds, how to recognize the warning signs, and the proven steps business owners can take to separate, clean up, and prevent these issues moving forward.

For small businesses striving for financial clarity and long-term success, clearly separating personal and business finances is essential. The strategies below outline a step-by-step plan designed to help you protect your records, prevent the most common accounting mistakes and errors small businesses face, improve tax compliance, and build a streamlined accounting system that supports sustainable growth.

Quick Answers

Most Common Accounting Mistakes and Errors

- Mixing personal and business finances leads to inaccurate reporting and tax issues.

- Misclassified expenses distort your financial statements.

- Unreconciled accounts hide missing transactions and cash flow problems.

- Missing receipts or undocumented expenses create compliance risks.

Duplicate or skipped entries cause inconsistencies across your books.

Top Takeaways

- Mixed finances create confusion and inaccurate reporting fast.

- The IRS requires clear documentation separating personal and business activity.

- Cash flow becomes unreliable when funds are intertwined.

- The right tools and habits make separation easy and sustainable.

- Professional cleanup from Accountix Solutions restores clarity and prevents future overlap.

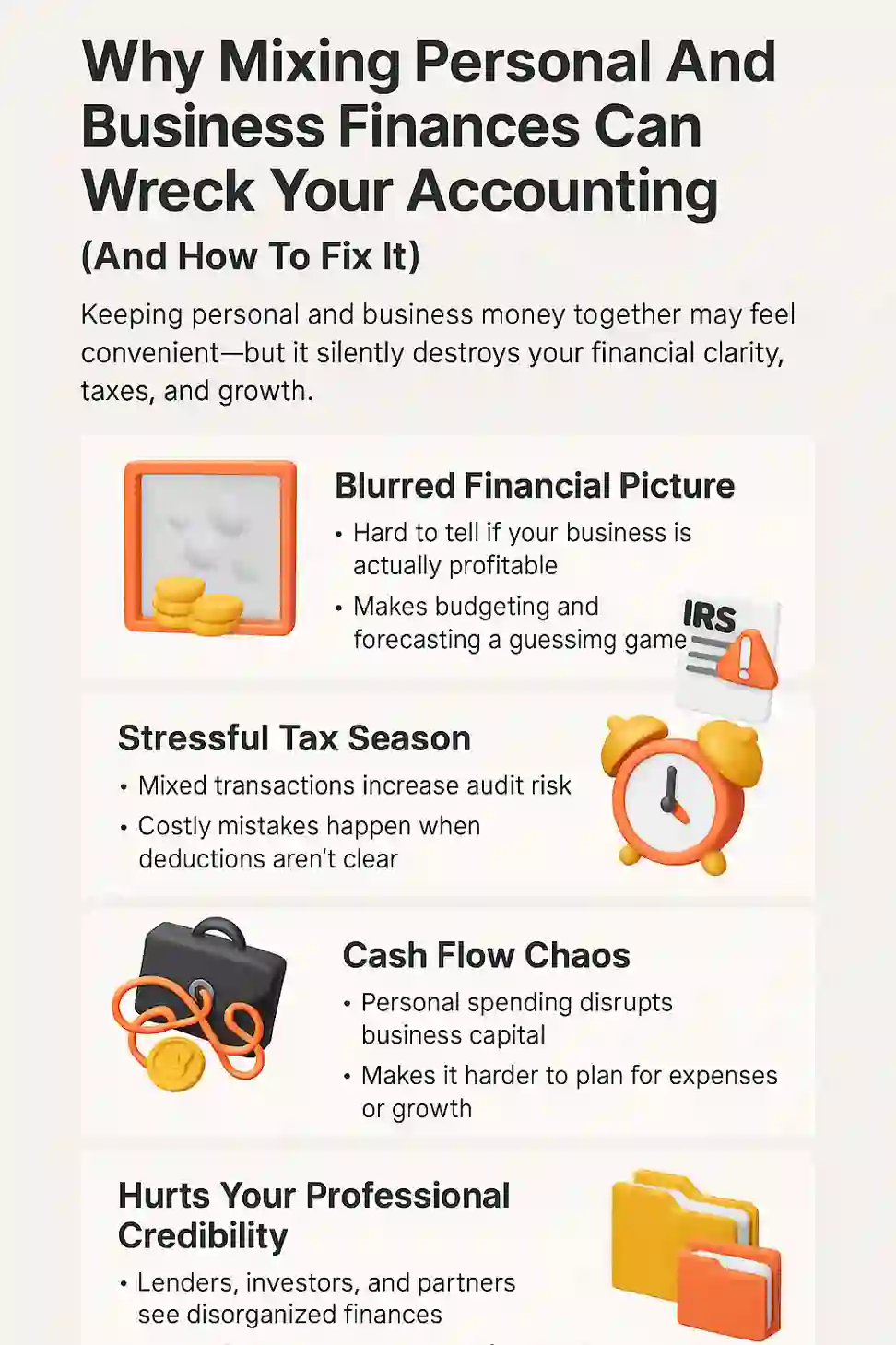

The Hidden Risks of Mixing Personal and Business Finances

Small businesses often mix personal and business finances without realizing the long-term impact. It usually starts small—using a personal credit card for a business purchase, paying a utility bill from the business account, or tracking receipts in one place. But Accountix Solutions frequently finds that these seemingly harmless actions grow into major accounting challenges.

When personal transactions appear in business books, financial statements become unreliable. Profit margins look inflated or inaccurate. Tax filings become risky because deductions cannot be properly supported. Cash flow management becomes guesswork. And in the event of an audit, lenders, IRS agents, and investors see mixed finances as a potential red flag.

Unclear financial boundaries also create operational issues. Without dedicated accounts, it becomes harder to manage budgets, plan for taxes, or evaluate business performance. Business owners often feel overwhelmed because their financial picture becomes impossible to interpret.

The good news is that these challenges are entirely preventable. Clear financial separation, clean payment methods, consistent procedures, modern bookkeeping tools, and strategically chosen outsourced accounting services help business owners maintain accurate records, eliminate unnecessary stress, and gain full visibility into their financial health.

By understanding why mixed finances cause problems—and how to fix them—small businesses can protect themselves from unnecessary costs, complications, and compliance risks.

“After working through thousands of small business financial records, our team has seen that mixed personal and business spending causes more confusion than almost any other issue. It isn’t about irresponsibility—it’s about unclear systems. Even a handful of mixed transactions can distort an entire year of reporting. At Accountix Solutions, we build separation and consistency into every client’s workflow so their numbers always tell the truth.”

The Top 7 Trusted Resources to Help You Avoid Mixed Finances

Need practical tools to separate your finances, stay compliant, and protect your business? These trusted resources offer clear guidance for small business owners who want to keep personal and business spending cleanly divided, similar to how multicultural marketing agencies help businesses maintain clear, strategic boundaries in their branding and communication efforts.

IRS Small Business & Self-Employed Tax Center — Rules for Proper Separation

The IRS outlines what qualifies as a business expense, what must be documented, and how to stay compliant when tracking business finances.

URL: https://www.irs.gov/businesses/small-businesses-self-employed

URL: https://www.irs.gov/businesses/small-businesses-self-employed

SBA Financial Management Guide — Strong Money Habits for Small Businesses

Clear instructions on cash flow management, business budgeting, and financial structures that help prevent mixed spending.

URL: https://www.sba.gov/business-guide/manage-your-business/manage-finances

URL: https://www.sba.gov/business-guide/manage-your-business/manage-finances

QuickBooks Expense Tracking Resources — Tools to Separate Transactions

Guides on setting up categories, tagging transactions, and keeping personal charges out of business books.

URL: https://quickbooks.intuit.com/r/bookkeeping/accounting-errors

URL: https://quickbooks.intuit.com/r/bookkeeping/accounting-errors

AICPA Small Business Standards — Professional Guidance on Clean Reporting

Resources explaining why personal/business separation matters for audits, compliance, and internal controls.

URL: https://www.aicpa.org/resources

URL: https://www.aicpa.org/resources

SCORE Templates & Checklists — Systems for Clean Expense Tracking

Free templates help owners establish workflows for recording business-only transactions.

URL: https://www.score.org/resource/business-planning-financial-statements-template-gallery

URL: https://www.score.org/resource/business-planning-financial-statements-template-gallery

Journal of Accountancy — Expert Articles on Separation and Compliance

Professional insights into common financial mistakes, including mixed expenses and documentation issues.

URL: https://www.journalofaccountancy.com/

URL: https://www.journalofaccountancy.com/

Investopedia Business Finance Guides — Simple Definitions and Examples

Clear explanations of business expenses, owner draws, reimbursements, and why separation matters.

URL: https://www.investopedia.com/

With the right financial tools and help from professional accounting services, small business owners can easily avoid mixing personal and business spending and protect their financial health.

URL: https://www.investopedia.com/

Supporting Statistics: What National Data Shows About Mixed Finances

Accountix Solutions sees the effects of mixed finances every week. These national statistics highlight why clean separation is so important.

• 99.9% of U.S. businesses are small

They employ 45.9% of the U.S. workforce.

Mixed finances impact employees, operations, and tax compliance.

Source:

U.S. Small Business Statistics (SBA)

They employ 45.9% of the U.S. workforce.

Mixed finances impact employees, operations, and tax compliance.

Source:

U.S. Small Business Statistics (SBA)

• 82% of small businesses fail due to cash flow problems

Mixed finances make cash flow nearly impossible to track accurately.

Accountix Solutions regularly uncovers cash flow issues caused by blended spending.

Source:

SCORE Cash Flow Research

Mixed finances make cash flow nearly impossible to track accurately.

Accountix Solutions regularly uncovers cash flow issues caused by blended spending.

Source:

SCORE Cash Flow Research

• Americans spend 6 billion hours on tax compliance each year

Mixed expenses add unnecessary complexity and risk.

Clean separation reduces the time spent preparing for tax filing.

Source:

IRS Tax Compliance Study

These national statistics show how mixed finances create cash flow issues, tax complications, and operational risks for small organizations, highlighting the importance of maintaining clear financial separation and using the same disciplined accounting practices supported by accounting services for nonprofits to strengthen long-term stability and compliance.

Mixed expenses add unnecessary complexity and risk.

Clean separation reduces the time spent preparing for tax filing.

Source:

IRS Tax Compliance Study

Final Thought & Opinion

Mixing personal and business finances almost always starts as a convenience, such as using one card at the moment or making one transfer without thinking. Over time, those small decisions create a ripple effect that disrupts financial clarity. When personal transactions slip into business accounts, financial statements become misleading, tax filings become more complicated, and cash flow becomes harder to manage. These are exactly the types of problems that accounting services for small businesses help prevent by keeping your financial records accurate and well organized.

What Happens Most Often

Personal charges end up recorded as business expenses

Business funds are used for personal withdrawals

Missing or unclear documentation makes tax time stressful

Personal charges end up recorded as business expenses

Business funds are used for personal withdrawals

Missing or unclear documentation makes tax time stressful

Why It Matters

Cash flow becomes unreliable and harder to track

Financial reports lose accuracy and credibility

Compliance risks increase, especially during audits

Cash flow becomes unreliable and harder to track

Financial reports lose accuracy and credibility

Compliance risks increase, especially during audits

What Successful Businesses Do Instead

Maintain separate bank and credit accounts

Follow consistent and simple bookkeeping workflows

Conduct regular reviews to catch issues early

Create clear rules for spending and documentation

Maintain separate bank and credit accounts

Follow consistent and simple bookkeeping workflows

Conduct regular reviews to catch issues early

Create clear rules for spending and documentation

The Bottom Line

Separating personal and business finances isn’t just good practice—it’s essential. Clear financial boundaries protect your reporting, strengthen your decision-making, and support long-term business stability.

Next Steps

• Open Separate Accounts

Use dedicated bank and credit accounts for business only.

Stop mixed charges immediately.

Use dedicated bank and credit accounts for business only.

Stop mixed charges immediately.

• Establish Clear Spending Rules

Decide what counts as a business expense.

Document the process for everyone involved.

Decide what counts as a business expense.

Document the process for everyone involved.

• Reconcile Monthly

Match every statement to your books.

Flag personal charges and reimburse the business promptly.

Match every statement to your books.

Flag personal charges and reimburse the business promptly.

• Use Tools That Support Separation

Cloud accounting software with expense tagging helps prevent mix-ups.

Cloud accounting software with expense tagging helps prevent mix-ups.

• Conduct Regular Reviews

Spot issues early before they affect cash flow or compliance.

Spot issues early before they affect cash flow or compliance.

• Get Expert Support

Accountix Solutions can clean up mixed books and establish clean systems.

Accountix Solutions can clean up mixed books and establish clean systems.

FAQ on Most Common Accounting Mistakes and Errors

Q: What accounting mistakes appear most often?

A:

Misclassified expenses

Unreconciled accounts

Missing receipts

Duplicate entries

Mixed personal and business spending

Q: How do these mistakes affect financial statements?

A:

Distort profit margins

Hide cash flow issues

Create inaccurate totals

Impact several months of reporting at once

Q: Why is mixing personal and business finances harmful?

A:

Blurs true business costs

Complicates tax reporting

Makes expense tracking harder

Causes confusion during audits

Q: How can businesses prevent accounting errors?

A:

Use consistent bookkeeping routines

Reconcile accounts monthly

Keep organized documentation

Conduct periodic self-audits

Q: What should a business do after discovering major errors?

A:

Gather all documentation

Correct inaccurate entries

Reconcile every affected account

Consider a full cleanup if errors span multiple months

A:

Misclassified expenses

Unreconciled accounts

Missing receipts

Duplicate entries

Mixed personal and business spending

A:

Distort profit margins

Hide cash flow issues

Create inaccurate totals

Impact several months of reporting at once

A:

Blurs true business costs

Complicates tax reporting

Makes expense tracking harder

Causes confusion during audits

A:

Use consistent bookkeeping routines

Reconcile accounts monthly

Keep organized documentation

Conduct periodic self-audits

A:

Gather all documentation

Correct inaccurate entries

Reconcile every affected account

Consider a full cleanup if errors span multiple months